Guided Wealth Management Can Be Fun For Anyone

Guided Wealth Management Can Be Fun For Anyone

Blog Article

Indicators on Guided Wealth Management You Need To Know

Table of ContentsNot known Details About Guided Wealth Management Some Known Incorrect Statements About Guided Wealth Management The smart Trick of Guided Wealth Management That Nobody is DiscussingAn Unbiased View of Guided Wealth ManagementSee This Report on Guided Wealth ManagementGuided Wealth Management for Dummies

Picking an efficient monetary expert is utmost important. Do your research and hang around to evaluate potential monetary advisors. It is acceptable to put a big effort in this process. Conduct an examination amongst the prospects and choose the most certified one. Advisor functions can differ relying on numerous variables, consisting of the type of financial consultant and the client's needs.A limited advisor must declare the nature of the limitation. Giving appropriate plans by examining the background, monetary information, and capacities of the customer.

Offering critical strategy to coordinate personal and company funds. Leading customers to implement the financial strategies. Reviewing the implemented plans' performance and updating the carried out intend on a normal basis regularly in various phases of customers' development. Normal monitoring of the financial portfolio. Keep tracking of the client's activities and validate they are following the best course. https://telegra.ph/Super-Advice-Brisbane-Your-Path-to-Financial-Freedom-07-29.

If any type of troubles are encountered by the management consultants, they arrange out the origin creates and address them. Construct a monetary threat analysis and review the possible result of the threat. After the conclusion of the threat evaluation version, the consultant will certainly analyze the outcomes and offer an ideal remedy that to be carried out.

The Only Guide to Guided Wealth Management

They will certainly aid in the success of the economic and employees objectives. They take the obligation for the supplied decision. As a result, customers need not be concerned regarding the decision.

Numerous measures can be contrasted to recognize a qualified and qualified expert. Generally, experts need to fulfill conventional scholastic credentials, experiences and certification recommended by the federal government.

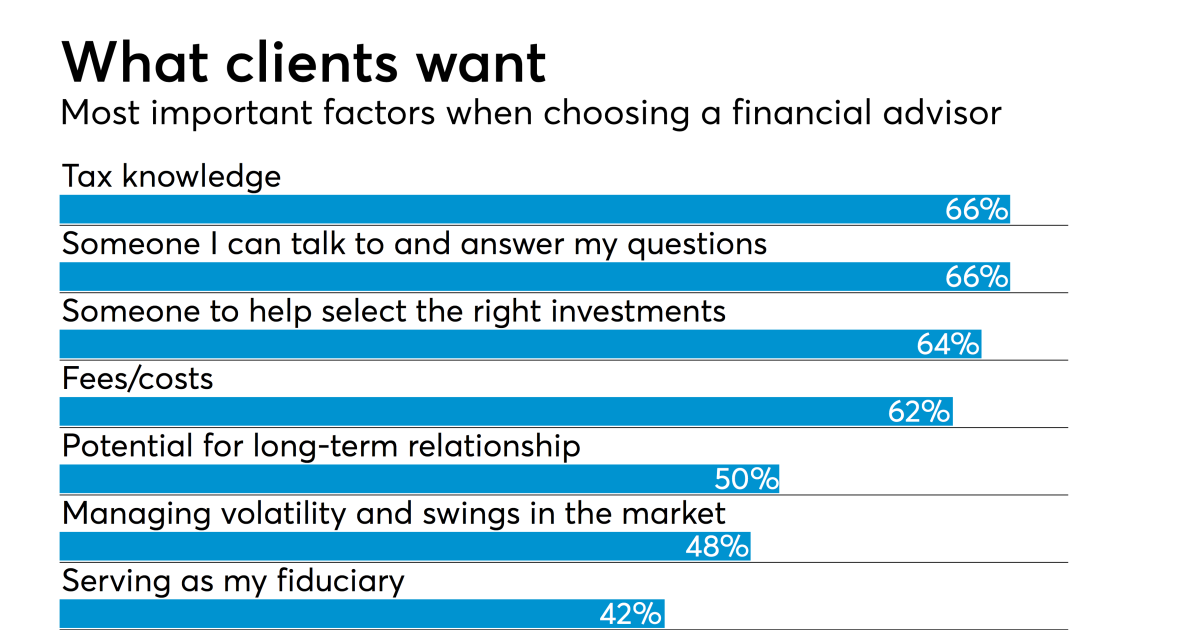

While looking for an advisor, please think about qualifications, experience, abilities, fiduciary, and repayments. Look for clearness up until you get a clear idea and full fulfillment. Constantly ensure that the recommendations you obtain from an expert is always in your benefit. Ultimately, financial consultants make best use of the success of an organization and additionally make it grow and flourish.

Some Ideas on Guided Wealth Management You Need To Know

Whether you need a person to help you with your tax obligations or supplies, or retired life and estate planning, or every one of the above, you'll find your response right here. Keep checking out to learn what the distinction is between a monetary expert vs coordinator. Primarily, any kind of specialist that can help you handle your cash in some fashion can be considered an economic advisor.

If your objective is to create a program to satisfy lasting monetary objectives, after that you possibly desire to get the services of a licensed economic planner. You can seek an organizer that has a speciality in taxes, financial investments, and retired life or estate planning. You may additionally inquire about designations that the coordinator lugs such as Qualified Financial Coordinator or CFP.

An economic advisor is just a broad term to describe a professional that can aid you manage your money. They might broker the sale and purchase of your stocks, handle financial investments, and aid you create an extensive tax or estate strategy. It is essential to keep in mind that a financial advisor should hold an AFS permit in order to offer the general public.

The Best Strategy To Use For Guided Wealth Management

If your financial expert lists their services as fee-only, you need to expect a listing of solutions that they offer with a break down of those charges. These professionals don't offer any type of sales-pitch and generally, the services are cut my review here and completely dry and to the factor. Fee-based advisors charge an in advance cost and after that earn compensation on the financial products you purchase from them.

Do a little research first to ensure the financial expert you work with will be able to deal with you in the lasting. The most effective area to start is to request references from family members, close friends, co-workers, and neighbours that are in a similar financial circumstance as you. Do they have a trusted monetary consultant and exactly how do they like them? Requesting referrals is a great way to learn more about an economic expert before you even meet them so you can have a better idea of how to handle them up front.

Guided Wealth Management - Truths

Make your potential expert answer these inquiries to your contentment before relocating forward. You may be looking for a specialty consultant such as someone that focuses on separation or insurance planning.

A financial consultant will certainly assist you with establishing attainable and reasonable objectives for your future. This can be either starting an organization, a family, preparing for retired life every one of which are very important chapters in life that need cautious factor to consider. An economic advisor will take their time to review your scenario, brief and long-term objectives and make recommendations that are appropriate for you and/or your family.

A research study from Dalbar (2019 ) has shown that over two decades, while the average financial investment return has been around 9%, the typical financier was just obtaining 5%. And the distinction, that 400 basis factors per year over 20 years, was driven by the timing of the investment decisions. Manage your portfolio Secure your properties estate preparation Retirement planning Manage your very Tax investment and administration You will certainly be called for to take a danger resistance survey to supply your expert a more clear image to establish your financial investment property allotment and preference.

Your consultant will analyze whether you are a high, medium or low risk taker and set up an asset allocation that fits your threat resistance and ability based upon the details you have actually offered. A high-risk (high return) person may spend in shares and building whereas a low-risk (reduced return) person might want to invest in cash and term down payments.

The Definitive Guide for Guided Wealth Management

Once you involve an economic expert, you don't have to manage your portfolio. It is crucial to have correct insurance policy plans which can offer peace of mind for you and your household.

Having an economic expert can be incredibly useful for many individuals, but it is necessary to evaluate the benefits and drawbacks before choosing. In this post, we will certainly discover the benefits and disadvantages of collaborating with a monetary consultant to assist you make a decision if it's the appropriate relocation for you.

Report this page